ArtistBomb, Inc. has not pitched in front of any investor or group of angel investors in Boston. We’ve had plenty of practice, and plenty of one-on-one conversations with mentors and gatekeepers. Their questions and comments have surprised me. These folks aren’t what I thought.

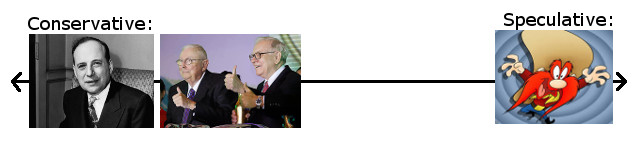

The Investor Spectrum

At the far “conservative” end you have Ben Graham, a conservative unsurpassed by anyone. Ben Graham was Warren Buffett’s teacher. He said, above all, you need to have a margin of safety. Value a business assuming:

- egregious omissions or misdirection may exist in the information you have,

- growth will be no faster than at any time in the past, and probably much slower,

- the best picture of the business comes only from looking at many years of performance averaged together, especially down years, and

- if all else fails, you can sell the furniture.

Consider all this when you value a business, and if the business securities still look cheap, you have a margin of safety.

Warren Buffett and Charlie Munger took the idea of margin of safety and combined it with the idea of economic moats. Find a business with something truly unbeatable, like Coca Cola’s global recognition, and you can sleep easier at night knowing that no competitor can hold a candle to you.

At the extreme other end of the spectrum is Yosemite Sam, prospector and speculator. His investment strategy is characterized by hope out of proportion to evidence.

I thought all startup investors were like Yosemite Sam. That was my limited experience, anyway. In talking to angel investors in Boston about ArtistBomb, though, I’ve been surprised by how many of them care about margin of safety (like, revenue), economic moats (like unbeatable advantages), and track record (strong team). These investors are, at best, only a distant cousin to Yosemite Sam.

But Yosemite Sam is out there. Shouldn’t you just try to find him and be done with fundraising for a while?

Three Kinds of Funded Startups

I think you should probably forget about Yosemite Sam. The crummy startups that I’ve seen him fund have been either

- Digging in Fort Knox, OR

- His personal friend.

The great startups that I’ve seen funded by others have what conservative investors want (at least, appropriate to their level of development). They have margins and moats and track records. And because they have these things, they’re most likely going to work out just fine.

Is your startup up to the task? What do you think you’d do differently to get towards margins, moats, or track records? Let me know in the comments below.