I’ve been writing a bit about technology startups lately. Let me flip back to the other end of the business spectrum — landlording — to share an interesting conversation I overheard recently:

Landlord One: How many landlords pay taxes on their rental income? It’s like no one. Everyone runs at a loss.

Landlord Two: Oh, no, my properties are very lucrative. I pay my taxes.

Landlord One: Then you’re doing it wrong. All of my properties are in separate trusts. My accountant shows me that each trust loses money every year, and if it were any other way, I’d get another accountant.

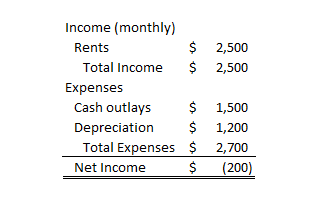

Let me explain what Landlord One means. Here’s what the income statement for one of his trusts probably looks like (I haven’t seen it; I have no connection to Landlord One):

The “depreciation” in the table above results from the following accounting practice: take the price you paid for the building, say, $250,000, divide that by 27.5 years, divide that by 12 months for our example, and the number you get, $757.58 per month, is how much you can deduct from your income for tax purposes. Repeat that for other “big purchases,” like a new driveway, a new roof, and new furnaces, and you can quickly get up to $1,200 per month in depreciation deductions.

Landlord One is thinking, “This is super. The IRS thinks I spent $1,200 per month, but I didn’t! Haha! That was cash going straight into my pocket!” Furthermore, the $200 per month loss can offset income from other sources, especially a salaried job, per the passive activity loss rule exception. (Sidebar: only the IRS would name a rule “passive activity”.)

The IRS can step in and say, “Your business has been losing money for too many years. We think it’s really a hobby. You can’t use your $200 per month loss to offset income from your job anymore.” As far as I know, this can happen for any business, but I’ve never heard of it happening for rental real estate.

Even if your business is never declared a hobby, there is still one big problem with Landlord One’s line of thinking:

Depreciation is a real expense.

It represents the ongoing capital you must invest in order for your business to remain in operation. Think about a house that hasn’t had any work done on its driveway, roof, or furnaces for 27.5 years. Would you want to rent an apartment there?

Think about it another way, as a function of purchase price. I wrote about this before, where I gave a similar example. If your depreciation is continually outstripping your income, it means you paid too much for your property.

Either way, your “fake” depreciation expense is going to come back around as a real reinvestment of capital. Either the roof will blow off and you’ll need to put a new one back on, making your entire year “cash flow negative,” or you’ll have to sell the degraded property at a steep discount to what the price would have been if it had been maintained.

So go ahead and claim those losses, Landlord One. They’re real.

“Go Ahead and claim those (depreciation) losses . .”? Keep in mind that depreciation on the building is not a write off, only a deferment. When you sell, you have to pay back that deferment at the Recaptured Depreciation rate of 25%. Is your situation worth deducting today’s depreciation and paying 25% at your tax rate when you may be retiring 27 years from now? Long term “Capital Gain” is another false tax. It’s the same house with the same value, only the value of the dollar has changed, so it’s phantom income. Regarding ongoing work at your rental properties, I’d rather try to reclassify the work as fully deductible “repairs” instead of losing your true expense in today’s dollars with cheap dollars later.