This is the question for any startup looking to measure their personal wealth creation, take on additional capital, or sell their business. Unfortunately, the answer is usually, “Somewhere between nothing and a whole lot.” You can do better.

Working Backwards: Step One

Think about what your business is going to look like when it’s big and stable (or stabilizing). For instance, “we’re going to be selling units (or service hours) to about 35% of the market, which will be growing at 3% a year, and increasing our penetration of that market by about 5% a year.” This sets some top-line revenue numbers.

Compare yourself to other businesses in similar roles and apply similar operating margins, R&D budgets, or other ratios to your business. This gets you to the bottom line.

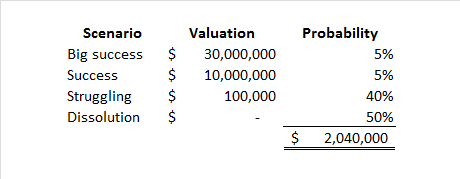

Think in terms of different scenarios (“best case,” “worst case,” dissolution, etc.) and how likely those scenarios are.

Working Backwards, Step Two

For each scenario above, run the forecast from Step One for about seven or ten years, from a period of no earnings (you’re reinvesting everything) to a period of justifiable margins. If you’re going to be the first arrival on the scene, you can justify higher margins; if you’re second or third to market, you’re going to have smaller margins.

Use a discounted cash flow analysis to create a valuation for each scenario as of the start of your “stable” period.

Product-sum the valuations and the probabilities to derive a weighted valuation.

Working Backwards, Step Three

Use your detailed project plan (perhaps using EVMS) to estimate the total capital and amount of time needed to get from where you are to where that future forecast begins. Give yourself lots of margin, because it’s not going to go according to plan.

The time required is the time horizon over which you further discount that valuation from Step Two.

The capital required is how much money you’re going to need, altogether.

For more information

Leave your comments below! Or if you feel like going to the library, see McKinsey & Company, Tim Koller, Marc Goedhart, and David Wessels, Valuation: Measuring and Managing the Value of Companies, 5th Edition. Hoboken, New Jersey: John Wiley & Sons, Inc., 2010. Print.

Reblogged this on KnoGimmicks Social Media & Web Design and commented:

Shark Tank will let you know how much your business is worth, brutally! Great post!

[…] It’s also the same concept underlying my previous post, How much is my startup worth? […]

[…] many skilled technicians can perform a discounted cash flow analysis? How many gifted programmers think in probabilities? How many of the potentially dozens of super-star employees who get stock options are also […]