Home » finance

Category Archives: finance

Two Must-Join Networking Groups for New or Aspiring Boston Entrepreneurs

About a year ago I left Terrafugia and launched myself solo into Boston’s entrepreneurship scene. The advice given to me by a distant mentor was “find some local entrepreneurship resources and get involved.” I started by Googling. I was amazed by how much exists in Boston. Two groups in particular have earned a lot of my attention on account of their polished and varied programming:

IEEE Boston Entrepreneur’s Network

(Visit Boston ENET.)

The format of the meeting provides “as you like it” networking time way before, before, and after a set of three carefully screened and rehearsed presentations. Way before the meeting you can pay your own way to dinner at Bertucci’s. This is how I ended up meeting two of my eventual co-founders. At the meeting location itself there’s time to mix and mingle over sodas and snacks. After the meeting you can swarm the speakers or, even better, go introduce yourself to someone who asked an interesting question in front of the group.

The presentations are moderated, well timed, complementary perspectives on a single theme. For instance, this month’s meeting was “How do you know you’re ready to start a company?” The first speaker, Greg Skloot of Attendware, talked about the difference between tinkering on a project and really knowing that you have a business. The second speaker, Joe Baz of Above the Fold, gave insights into the personal aspects of entrepreneurship. Third we had Vicki Donlan, an impressively experienced consultant able to speak to a wide variety of startup success and dysfunction. We closed with Bill Seibel, whose resume slide made you turn to the person next to you and whisper “Wow.”

Every time I go to ENET:

- I meet someone helpful to my startup.

- I’m entertained by at least one charismatic and engaging speaker.

- I find a new role model of entrepreneurial success.

The Capital Network

(Visit TCN.)

This is like getting a laser-focused entrepreneur’s MBA for $400. Before I joined, I knew more than the average entrepreneur about debt and equity, about investment, and about business valuation. But the rules and norms for startups are usually a little different, and often they’re quite esoteric. For instance, when you buy $50,000 worth of stock of a publicly traded company worth $5,000,000, you get 1% of the company. When you buy the same amount from a startup worth the same thing, you get 0.99%. The reason is because of this difference: buying publicly traded stock gives you existing shares; buying startup stock causes new shares to be issued. If you’re thinking about taking investor money, this consideration and others must enter into your calculations, because the dilution effect on you means your share of the company will shrink with each investment round.

Unlike ENET, TCN often has a single speaker go for the full 90 minutes. In this format, the topics are meandering overviews of narrow subjects driven partly by slides and partly by audience questions. It’s a real good chance to ask about your specific startup. For instance, at the “founder issues” talk given by Paul Sweeney at Foley Hoag, we had a good audience-driven discussion about setting the strike price of stock options given to employees. (See my previous article here.) They also experiment with panels and roundtable discussions, which are helpful for giving diverse perspectives or more time in smaller groups.

Every time I go to a TCN lunch:

- I get delicious, healthy food.

- I can ask detailed questions of a knowledgeable speaker.

- I meet someone new starting an exciting business.

Summary

If you’re in Boston, you get access to lots of good Internet resources just the same as anyone else anywhere in the world. But these two groups are fun and, if you’re really going to do this for the first time, absolutely essential.

Landlords Pay No Taxes?

I’ve been writing a bit about technology startups lately. Let me flip back to the other end of the business spectrum — landlording — to share an interesting conversation I overheard recently:

Landlord One: How many landlords pay taxes on their rental income? It’s like no one. Everyone runs at a loss.

Landlord Two: Oh, no, my properties are very lucrative. I pay my taxes.

Landlord One: Then you’re doing it wrong. All of my properties are in separate trusts. My accountant shows me that each trust loses money every year, and if it were any other way, I’d get another accountant.

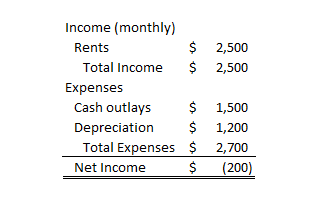

Let me explain what Landlord One means. Here’s what the income statement for one of his trusts probably looks like (I haven’t seen it; I have no connection to Landlord One):

The “depreciation” in the table above results from the following accounting practice: take the price you paid for the building, say, $250,000, divide that by 27.5 years, divide that by 12 months for our example, and the number you get, $757.58 per month, is how much you can deduct from your income for tax purposes. Repeat that for other “big purchases,” like a new driveway, a new roof, and new furnaces, and you can quickly get up to $1,200 per month in depreciation deductions.

Landlord One is thinking, “This is super. The IRS thinks I spent $1,200 per month, but I didn’t! Haha! That was cash going straight into my pocket!” Furthermore, the $200 per month loss can offset income from other sources, especially a salaried job, per the passive activity loss rule exception. (Sidebar: only the IRS would name a rule “passive activity”.)

The IRS can step in and say, “Your business has been losing money for too many years. We think it’s really a hobby. You can’t use your $200 per month loss to offset income from your job anymore.” As far as I know, this can happen for any business, but I’ve never heard of it happening for rental real estate.

Even if your business is never declared a hobby, there is still one big problem with Landlord One’s line of thinking:

Depreciation is a real expense.

It represents the ongoing capital you must invest in order for your business to remain in operation. Think about a house that hasn’t had any work done on its driveway, roof, or furnaces for 27.5 years. Would you want to rent an apartment there?

Think about it another way, as a function of purchase price. I wrote about this before, where I gave a similar example. If your depreciation is continually outstripping your income, it means you paid too much for your property.

Either way, your “fake” depreciation expense is going to come back around as a real reinvestment of capital. Either the roof will blow off and you’ll need to put a new one back on, making your entire year “cash flow negative,” or you’ll have to sell the degraded property at a steep discount to what the price would have been if it had been maintained.

So go ahead and claim those losses, Landlord One. They’re real.

Why I Wouldn’t Bet the Farm

How many times have you heard an entrepreneurial success story where the founder took huge risks and won big? It usually goes like this: they took out a home equity loan, maxed out their credit cards, and pitched violently forward into the ditch of debt only to be saved at the last minute by a business miracle. It seems like that’s the way folks become successful.

I was at Boston ENET a while back and I heard a story just like this. The speaker talked about all that debt she had taken on, and all the cost-cutting she had done personally to squeak by. She offered as an aside the tidbit that she had taken a ZipCar to get to ENET that night because her own car had been repossessed.

I think I’ve heard about similar “all in” bets from Elon Musk for Tesla, and Marla Beck for bluemercury.

Some folks don’t quite subscribe to this approach, and I’m wondering whether that will forever consign them to the realm of the mediocre. The alternative looks like this: work a corporate job earning more than you need and save a big cash cushion. Buy one of the zillions of decent businesses out there with established models and relatively straightforward ways to make money from your cushion. Now you’re in some measure financially independent, forever, and you haven’t bet the farm. If you’re going to start a totally new business entity, you can continue this cautious approach and sprinkle in some professional services or other “easy & early” products to keep the lights on while you spool up.

That’s called bootstrapping, and I can’t say it makes for the sexiest story. But then, it’s not very sexy to close up shop, declare personal bankruptcy, and go back to your old job, either.

The Surprising Math Behind Startup Dilution

This recently blew my mind, so I thought I’d share some simple math with you.

Imagine an investor wants to invest in your startup. He says it’s worth $1 million and he wants to invest $500,000. He’s going to take half your company, right? Wrong. He’s going to take one third. At least, that’s the usual math.

In publicly traded stocks, it works the way I’d expect. If I buy $500,000 worth of stock in a company with a capitalization of $1 million, I’ll own half the company. That’s because my stock came from other stockholders. My money went to pay out existing owners.

In the startup world, that’s very unusual. All the old money has to stay to keep the business alive. There’s no “capitalization” yet, not in the sense of capital sitting there doing its job. So when someone invests in your startup, they don’t buy shares from existing owners. They add to its value.

![]()

So in the example above,

![]()

Don’t believe me? Think about it in terms of share price. Say you have 1 million shares. A $1 million valuation divided by 1 million shares = $1/share. The new investor buys 500,000 shares in your company at $1/share, equaling his $500,000 investment. You create those shares by issuing new shares, rather than by selling him existing shares. Now there are 1.5 million shares out there, and he owns 500,000. So what does the investor own? One third.

How to Count in Sklansky Dollars

Here’s a neat concept that everyone can use, from professional poker players to Warren Buffett. In Alice Schroeder’s biography, The Snowball, she describes how in his youth, Warren was good at assigning odds to each horse in a race. This is called “handicapping.” Schroeder uses this as an analogy to explain how Buffett calculates investment probabilities.

It’s also the same concept underlying my previous post, How much is my startup worth?

Here it is in simple terms:

Your roof is leaking somewhere. The roofer offers a complete replacement of the roof for $10,000. He offers a 100% guarantee that your roof will be leak-free for three years, or else he’ll come back and completely replace it again for free. He gives you an alternative, as well: he can patch this one mossy spot for $2,000. He estimates that there’s a 25% chance this patch will fix the leak.

If you choose the patch, you have a 25% chance of saving yourself a $10,000 replacement. That’s kinda like saving 25% of $10,000, or $2,500. To get this chance, you have to spend $2,000 for the patch. In mathematical terms,

Value of Patch = -$2,000 + 0.25*$10,000 = $500

The $500 is what I’m calling Sklansky dollars, and it represents the increased economy of trying the repair first.

Crucially, these 500 Sklanksy dollars were still there even if you elect the repair and it doesn’t work. Now you’re in for the cost of the patch, $2,500, plus the cost of the replacement, $10,000, or $12,500 total. It hurts. But it was justifiably the right call to try the patch first because you had positive Sklansky dollars for that decision.

For further reading, read it in poker terms.

How NOT to treat your employees

A company I’ve done some work for in the past recently lost a major bid. The super-boss called the entire team into a conference room and said, “You lost the bid, you’re all fired.” Some of the team had been with the company for over thirty years. The carnage hit multiple rungs of the ladder, from some new engineers all the way up to a vice president. All of them had been working hard right up until the meeting.

The particulars of the situation — how the message was actually conveyed, the extent to which there were equitable severance packages, the degree to which each may have failed to perform his or her duties — matter a great deal, and because I wasn’t there, I shouldn’t pass judgment. I can say, however, that the company culture could have grown in a petri dish. It was the worst I’ve seen of leadership in corporate America. The folks who were let go might rightly miss their lost paycheck, but at least they get a chance at a more ethical work environment somewhere else.

When it comes right down to it, the people associated with your business are your business. If your customers all quit, or if your employees all leave, you’ve got nothing. The effects of this are obvious from small-time real estate, where sole proprietorships only ever sell at book value (the cost of the house), all the way up through corporate America, where “succession planning” is a big deal.

Good companies recognize this by offering training and development. In terms of performance reviews, outside training courses, and other self-improvement perks, employees at mid-size companies like the one I mention above probably receive over $5,000 a year in improvement-related perks. At some companies, like UTC, benefits can be far more substantial. My favorite example is Toyota, who (although I can’t remember where I read it) didn’t lay off anyone at their US Sienna factory and instead set them in motion on a circular assembly line, honing and improving their techniques until the recession picked up enough where they were on A-work again.

Suppose GAAP required capitalizing employee training and holding it on the books as a form of goodwill. Then when you fired someone, you’d be forced to recognize the true impact of your decision: you’d have to write down all that training. Talk about restructuring charges.

Suddenly “you lost the bid, you’re all fired” might not seem like such a good idea. Maybe there’s another way to make some money with that team…

How much is my startup worth?

This is the question for any startup looking to measure their personal wealth creation, take on additional capital, or sell their business. Unfortunately, the answer is usually, “Somewhere between nothing and a whole lot.” You can do better.

Working Backwards: Step One

Think about what your business is going to look like when it’s big and stable (or stabilizing). For instance, “we’re going to be selling units (or service hours) to about 35% of the market, which will be growing at 3% a year, and increasing our penetration of that market by about 5% a year.” This sets some top-line revenue numbers.

Compare yourself to other businesses in similar roles and apply similar operating margins, R&D budgets, or other ratios to your business. This gets you to the bottom line.

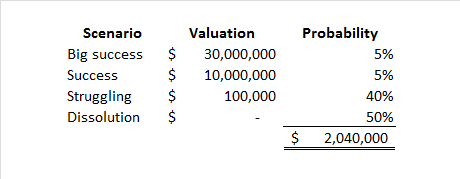

Think in terms of different scenarios (“best case,” “worst case,” dissolution, etc.) and how likely those scenarios are.

Working Backwards, Step Two

For each scenario above, run the forecast from Step One for about seven or ten years, from a period of no earnings (you’re reinvesting everything) to a period of justifiable margins. If you’re going to be the first arrival on the scene, you can justify higher margins; if you’re second or third to market, you’re going to have smaller margins.

Use a discounted cash flow analysis to create a valuation for each scenario as of the start of your “stable” period.

Product-sum the valuations and the probabilities to derive a weighted valuation.

Working Backwards, Step Three

Use your detailed project plan (perhaps using EVMS) to estimate the total capital and amount of time needed to get from where you are to where that future forecast begins. Give yourself lots of margin, because it’s not going to go according to plan.

The time required is the time horizon over which you further discount that valuation from Step Two.

The capital required is how much money you’re going to need, altogether.

For more information

Leave your comments below! Or if you feel like going to the library, see McKinsey & Company, Tim Koller, Marc Goedhart, and David Wessels, Valuation: Measuring and Managing the Value of Companies, 5th Edition. Hoboken, New Jersey: John Wiley & Sons, Inc., 2010. Print.

Financial Figuring for Landlords: Working Capital

What will you do if that old roof floods your top floor apartment, or if a cast iron drain pipe cracks just as you’re paying for bedbug extermination? What if the jobs cost $10,000? Do you call up your regular contractor and cut a check without batting an eyelash, or is this is a crisis necessitating soul searching, an emergency loan, or perhaps even a brave attempt at “deferred maintenance”? If you couldn’t afford a $10,000 emergency repair, you’d be in good company. Most small time property owners have a shortage of operating cash. But you can do better.

For large, established companies, there’s a test used to evaluate their ability to survive a “disaster” scenario. It’s called “the acid test.” The phrase comes from bygone days when gold was authenticated by dropping acid onto it. Gold won’t react, so if it’s “good as gold,” the acid has no effect. For businesses, “passing the acid test” usually means having enough liquid cash to cover more than an entire year’s expenses. That’s a heavy burden for a rental property, but if you manage that way, you can have some measure of peace of mind.

You can calculate the “acid test ratio” for your property by adding all your cash accounts for the business and dividing by all your liabilities for the next year. Your liabilities include the total of all interest, all insurance premiums, all real estate taxes, and all expected repairs. Suppose you have $12,000 set aside in the property’s rainy day fund. Suppose each month you pay $800 in interest, $300 in insurance, $300 in taxes, and $200 in repairs. All those expenses, times 12 months in a year, means you have liabilities of $19,200. Your $12,000 in cash divided by your $19,200 in liabilities means you have an “acid test ratio” of 0.625. A typical publicly traded manufacturing company has an acid test ratio of 1.25 to 1.5, more than double.

Now I’ve spoken with landlords about this, and most express shock and dismay that they should have to keep so much cash set aside. With monthly income guaranteed by leases, you might reasonably use another test, called “the quick ratio,” which lets you count receivables as “cash” because you’ll get them quickly. We can calculate this using the example above. If your tenants are obliged to pay $1,000/mo for the remaining nine months on their lease, you get to add another $9,000 in “cash.” Now $12,000 cash plus $9,000 receivables = $21,000. Divide this by $19,200 and your quick ratio is greater than one, just where you want to be. But be honest and don’t count month-to-month’s at face value. And if you’re dealing with tenants who might be headed for eviction or non-renewal, don’t count a full year of their lease at face value, either.

However much money you choose to set aside, the moral here is that large, established businesses set aside a lot of money for rainy days. As a small business, perhaps with limited credit, it’s important for you to do so, as well, and to keep that money allocated separately as a rainy day fund. You’ll be able to weather any storm if you do.

Miracle on 1st Street SE

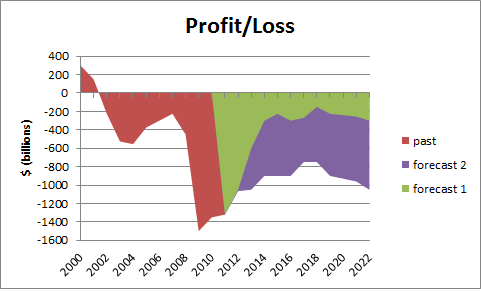

Imagine that you are the proud manager of the only company that provides food to the people who live in a large area around your plant. Your CFO comes to you for the quarterly update and for the first time in a long time it’s good news. He shows you the graph below:

“We haven’t made money in ten years. If we do nothing, we’ll be on forecast 1, still losing money, but the bleeding is slowing down. We’re going to get through it. We’re lucky that the cost savings and price increases we put in place over the last ten years have set us on that path, because sales and operations are demanding even lower prices and bigger budgets. If we were going to give them what they wanted, we’d be on forecast 2 and still hemorrhaging cash.”

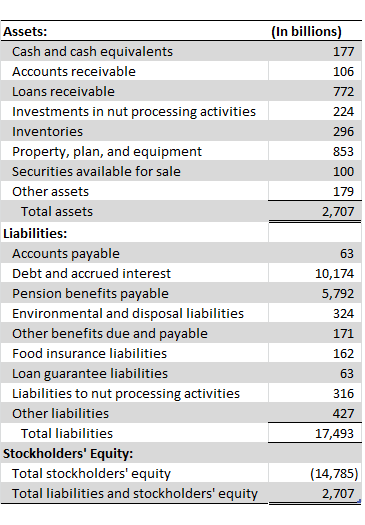

You think about it for a second and ask your CFO, “What does our balance sheet look like?”

He pulls out a copy of the balance sheet and hands it across your desk:

“Oh, hmm, ” you say. “I see our shareholders are in the red by about $15 trillion. God love ’em, they do support us. Let’s give sales and operations what they’re asking for.”

Your CFO should be shocked, but by now he’s totally resigned to your insane management of the company. “Okay,” he says, “I’ll call up our overseas competitors and get additional funds.”

You reassure your CFO, saying, “Don’t worry, they know we’re the only company providing food here. If they need us to pay off the debt, they’ll let us know, and we’ll just raise prices. Our customers will have to pay it. But let’s try to avoid that, okay? Also, call some emergency meetings with sales and operations. Make them work through the holidays to make sure we get onto forecast 2.”

You might think you’d be insane to run a company this way, but oddly enough, this is exactly what we’re doing to ourselves in the United States. See, for instance,